Did you know that nearly half of U.S. employers offer tuition assistance, and among those that do, four out of five already support an MBA in tech management? For (future) CTOs and senior engineering leaders, that implies building a compelling business case.

In ~7 minutes, you’ll learn: (1) why CFOs green-light MBAs even in tight budgets, (2) how to turn modules into deliverables that hit your OKRs, and (3) the best months to ask based on your fiscal year.

TL;DR

- Why companies pay: Sponsorship reduces hiring risk, improves retention/internal mobility, and closes tech-capability gaps—so CFOs fund it even in lean years.

- Make it business, not school: Treat each MBA module as a work artifact tied to a measurable OKR (e.g., unit-economics model, reliability playbook, AI use-case brief).

- Ask at the right time: Submit your proposal 60–90 days before budget lock, and align it with L&D resets and performance-review cycles.

- What to bring: a 5-year ROI snapshot (NPV, payback), a Module→Business-Win table, and a delivery plan with blackout dates/coverage.

- What’s next: Part 2 adds the ROI calculator + pitch kit; Part 3 covers negotiation scripts and deal structures.

Table of Contents

Why Companies Pay for MBAs (and Why Tech Is Different)

When budgets are tight, smart CFOs fund what retains talent, reduces hiring risk, and builds capabilities they can’t buy fast enough. The stats prove that employer-funded education checks all three boxes.

At Cigna, for instance, a rigorous study of its tuition program showed a 129% ROI from avoided talent costs:

- Participants were 10% more likely to be promoted.

- 8% more likely to be retained.

- 7.5% more likely to move internally.

Internal Mobility as the Retention Engine

LinkedIn’s data shows employees stay ~41% longer at companies with high internal hiring because people can see a path without leaving.

How does that stat tie to the MBA in Tech Management? Well, it formalizes cross-functional skills (strategy, finance, product, ops) that make those internal moves viable.

Tech Talent Shortages and AI Drive

Bain reports 44% of executives say lack of in-house expertise is slowing AI adoption, with AI-skills demand growing 21% annually and shortages expected through 2027. McKinsey similarly finds that only 16% of executives feel comfortable with their current tech talent, and 60% cite scarcity as a top inhibitor.

Gartner’s CIO research shows leaders are responding by upping upskilling/reskilling plans and expanding IT headcount despite market noise.

These are all clear signals that education spending is a talent strategy, not a perk.

What This Means for You

Frame the MBA as a retention and capability play, then prove it with internal-mobility outcomes and a simple ROI. That’s the language CFOs and CHROs already use. For a deeper dive on structuring that ROI case (and when sponsorship pays for itself), see CTO Academy’s MBA ROI explainer.

Mapping MBA Deliverables to Your Org’s 3-Year Roadmap

Treat the MBA as a portfolio of work artifacts your execs would fund anyway—each tied to a measurable OKR. The goal is to present the narrative in which each module yields a deliverable your exec team would fund anyway (business case, migration plan, pricing experiment, etc.). The important thing to remember here is that it has to be tied directly to a measurable OKR.

Fast 5-step Mapping

- Pull the 3-year outcomes (ARR (Annual Recurring Revenue), margin, reliability, AI adoption, risk posture).

- Select 4–6 company OKRs you can move (one owner per OKR).

- Map MBA modules to artifacts that advance those OKRs.

- Time modules to quarters when the organization makes related decisions (budgeting, roadmap commits, vendor renewals).

- Define acceptance & metrics (who signs off, how it’s measured, by when).

Module-to-Business Mapping (example OKRs for quick scan)

| MBA Module | Deliverable you’ll ship | Example OKR/Metric it moves |

| Digital Strategy | 3-year platform strategy with trade-offs | ≥20% of new ARR from a new SKU by Q4 FY26 |

| Managerial Finance for Tech Leaders | Unit economics model + CFO-ready business case | Reduce infra COGS (Cost of Goods Sold) per active user 15% YoY |

| Product Mgmt & Customer Discovery | Adoption experiment plan + discovery insights | Increase WAU (Weekly Active Users) for Feature X +15% within 90 days |

| Data & AI for Leaders | AI use-case shortlist + model feasibility brief | Improve sales forecast MAPE (Mean Absolute Percentage Error) −20%; lead-score AUC >0.75 |

| Operations/DevOps | Reliability playbook (SLOs, error budgets) | MTTR (Mean Time to Recovery) <30 min, change-fail <10%, 99.95% SLO met |

| Platform/Cloud Architecture | Cloud cost optimization roadmap | Idle resource cost −25%; savings-plan coverage 80% |

| Cybersecurity & Risk | Top risks register + remediation plan | Critical vulns remediated ≤14 days; ISO audit passed |

| Org Design & Leadership | Capability map + hiring/upskilling plan | Regrettable attrition <8%; 2 cross-functional promos |

| Negotiation & Stakeholder Influence | Vendor consolidation + contract playbook | SaaS footprint −20%; $500k annualised savings |

| GTM (Go-To-Market strategy) for Tech Leaders | Solution-engineering assets (ROIs, ref arch) | Enterprise sales cycle −15%; POC-to-close +10% |

Pro tip: co-supervise each artifact with the exec who owns the metric (e.g., CFO for unit economics, COO for reliability, CISO for risk). Each signature adds fuel to sponsorship.

Quarter-by-quarter example (Staff Engineer → Director)

- Year 1, H1: Digital Strategy → draft platform strategy; Product Mgmt → validate adoption levers.

- Year 1, H2: Finance → unit-economics model; DevOps → SLO/error-budget framework piloted.

- Year 2, H1: Cloud Architecture → cost-reduction roadmap; Security → remediate top-5 risks.

- Year 2, H2: Data/AI → forecasting uplift; Negotiation → vendor renewals locked at lower TCO.

- Year 3: Scale wins; convert artifacts into a director-level operating plan; measure OKR outcomes quarterly.

One-page “module brief” (paste into your proposal)

- Business problem: Which OKR and why now?

- Hypothesis & scope: What the module deliverables will change.

- Outputs: Named artifacts + links (deck, model, runbook).

- Success metric: Exact target & timeframe.

- Stakeholders & sign-off: Name the approver.

- Risks & dependencies: What could block delivery?

This makes your MBA feel less like time away and more like a structured, low-risk way to hit the plan, which is exactly what sponsors want to buy.

Timing the Ask: Budget Cycles, L&D Windows & Head-Count Plans

When is the best time to ask?

Ask before budgets lock and when retention is on the agenda. In other words, match your ask to your company’s fiscal calendar.

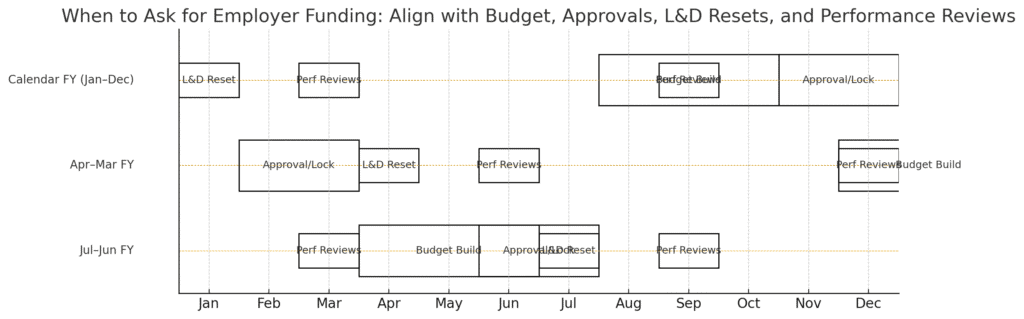

Now, most companies fall into three fiscal patterns. Use these rules of thumb to land in the “yes” window:

Where the “yes” lives (by fiscal year)

Calendar FY (Jan–Dec)

- Budget build: Aug–Oct → Ask in Jun–Aug so your line item enters the AOP (Annual Operating Plan).

- Approvals/lock: Nov–Dec → If you missed the AOP, pitch as a mid-year reallocation with a start next FY.

- L&D resets: Jan → Tap fresh tuition allowances early.

- Performance reviews: Mar and Sep → Tie to retention and promotion planning.

Apr–Mar FY (common in UK/Europe/APAC)

- Budget build: Dec–Feb → Ask in Sep–Nov.

- Approvals/lock: Feb–Mar → Late? Use carry-forward or professional-development balances to bridge until April.

- L&D resets: Apr.

- Performance reviews: Jun and Dec.

Jul–Jun FY

- Budget build: Mar–May → Ask in Dec–Feb.

- Approvals/lock: May–Jun.

- L&D resets: Jul.

- Performance reviews: Feb/Mar and Aug/Sep.

Five timing tactics that raise approval odds

- Back-solve from the budget: submit 60–90 days before the plan is finalized so Finance can create a cost center and spread payments across years.

- Ride retention moments: put the proposal on the agenda for performance reviews, stay interviews, or promotion boards, when managers already have a budget for retention.

- Avoid freeze zones: don’t ask at the end-of-quarter or end-of-month crunch, or during organizational reshuffles when budget owners change. If a reorg is imminent, line up the new approver first.

- Stage the start: if the AOP window is closed, propose pilot funding now (e.g., first module) with the remainder coded into next FY’s L&D.

- Pre-wire dissent: meet the CFO’s Financial Planning & Analysis partner and HR business partner one-to-one the week before the formal ask; incorporate their feedback so the decision meeting is a rubber-stamp.

What to put on the calendar invite (so your sponsor shows up)

- Subject: “Retention + Capability Investment: Tech MBA Sponsorship Proposal (15 min)”

- Attachments: 1-slide ROI summary, your Module-to-Business Win table, and program details.

- Decision request: “Approval for 50–75% sponsorship, with a 12-month retention clause and delivery guardrails.”

PRO TIP: Use the PNG above in your deck as a quick explainer for why you’re asking now, and tailor the highlighted window to your company’s fiscal year.

Objection-handling Scripts (use verbatim or tweak)

Let’s quickly run through a couple of scenarios that might at first seem like you ran into a wall.

1) “It’s too expensive.”

You: “Compared to replacing a senior engineer/director, the fully-loaded attrition cost is typically 50–200% of salary. Sponsoring {X%} costs {amount/year}, spread over {N} years, with a payback in Year {Y} (see ROI). It’s the lower-risk retention investment, and the deliverables map directly to our {OKR}.”

2) “We can’t afford the time away from delivery.”

You: “I’m capping study at {h/week} outside critical windows, with blackout dates during releases and no exams while on-call. Coverage is pre-agreed with {names}. Every module outputs a work artifact we already need, so you’re buying delivery, not time off.”

3) “We’ll need claw-backs if you leave.”

You: “Agree. I’m proposing a {12–18}-month pro-rated retention clause post-completion, plus grade ≥ {threshold}. If performance or delivery slips, funding pauses. That protects the company and keeps incentives aligned.”

4) “This sets a precedent.” (fairness)

You: “Let’s treat this as a pilot sponsorship aligned to L&D policy: role relevance, module-to-OKR mapping, retention clause, and performance guardrails. I’ll document the process so HR can reuse the template.”

5) “Is this program credible?”

You: “It’s an accredited MBA in Tech Management with assessment tied to real business outcomes. I’m attaching accreditation details and two employer references; we can add a 90-day review checkpoint.”

As you could see, there is a response to any objection or excuse. You just need to think business-first. Let’s now explain the six most prominent negotiation tactics you can deploy to lock the funding.

Negotiation Tactics for Senior Technologists

Your goal isn’t a single price; it’s a package that balances cost, delivery, and retention. Use anchors tied to real business costs, present multiple equivalent offers (MESOs), and trade concessions, not favors.

T1: Anchor tuition to recruitment/attrition costs

- Open with the business baseline, not the program price. Typical fully-loaded replacement cost for senior engineers/managers runs ~50–200% of salary (recruiting fees, sign-on, ramp, lost throughput).

- Translate sponsorship into risk-reduction. For example, “Sponsoring $14k across two years is <10% of replacing this role and keeps delivery knowledge in-house.”

- Annualize the ask (e.g., “$7k/year vs. ~$140k+ risk on attrition and ramp.”)

- Use your ROI sheet as proof. Lead with 5-year NPV, payback year, and 50/75/100% sensitivity models.

Stay tuned for an upcoming tutorial on how to calculate and build your ROI in under 20 minutes.

Sample wording (CFO/FP&A):

“To benchmark the spend: replacing a Staff-Engineer-to-Director track typically costs ~1.0–1.5× salary all-in. This proposal is $7k/year over two years with a payback in Year 4. We also add a pro-rated retention clause, which directly lowers our attrition risk.”

T2: Present MESO offers

What is MESO?

MESO stands for “Multiple Equivalent Simultaneous Offers.” It is a tactic where you present several different proposals at once, each equally acceptable to you, so you can learn the other side’s priorities while preserving your own value.

Offer three sponsorable packages so Finance chooses how to say yes. Remember, you win with any of them.

| Package | Company pays | You cover | Guardrails | Retention |

| A. Standard | 50% tuition | Books/exams | 8h/week cap; release blackout | 12-month pro-rated |

| B. Value | 75% tuition | Travel/time | Quarterly OKR deliverables sign-off | 18-month pro-rated |

| C. Pilot→Full | 100% first module, 50–75% remainder next FY | — | 90-day review gate; grade ≥ B+ | 18-month pro-rated from completion |

Sample wording:

“I’ve prepared three options. Each ties funding to measurable outcomes and retention. I’m comfortable with any of them; which fits the budget best?”

T3: Trade-offs: retention clause vs. schedule flexibility

Tie every concession to a reciprocal give.

- Longer retention ↔ Higher sponsorship: “If we extend retention from 12 to 18 months, can we move from 50% to 75% company coverage?”

- Part-time workload protection ↔ Blackout calendar: “I’ll cap study at 8h/week and avoid release windows; in exchange, could we confirm 75% sponsorship?”

- Pilot milestone ↔ 100% of module 1: “If the first module hits the OKR deliverable and grade ≥ B+, we auto-approve 75% for the remaining modules.”

Sample wording (CHRO/HRBP):

“To address fairness and delivery, I’ll adopt an 18-month pro-rated retention clause and a blackout calendar for launch weeks. In return, can we confirm 75% sponsorship across the program with a 90-day performance checkpoint?”

T4: Frame delivery as insured, not interrupted

- Guardrails you propose: study-hour cap, release/peak blackout dates, on-call exclusion, coverage plan by name, grade threshold with pause/exit if performance slips.

- Convert modules to business artifacts (from the previous section) to show the company is buying outcomes, not time off.

Sample wording (CTO/Manager):

“No impact on critical delivery: I’ll study outside blackout windows, keep an 8h/week cap, and hand off on-call during exam weeks. Each module produces artifacts we’ve already committed to (unit economics deck, SLO rollout), reviewed in our QBR.”

T5: Use numbers that invite agreement

- Per-paycheck framing: “At 75% sponsorship on $20k tuition, that’s ~$96 per paycheck over two fiscal years.”

- Budget coding: “Split across L&D and capability development; first module in this FY, remainder in next FY’s AOP.”

- Cost avoidance line: “One prevented resignation covers this program several times over.”

T6: Close with a decision script (and deadlines)

Meeting close:

“Given the ROI and guardrails, my recommendation is Package B (75%) with an 18-month pro-rated retention clause and quarterly OKR reviews. If we can align today, I’ll enroll for the {start date} intake and send HR the signed terms.”

If you hit resistance on price:

“Happy to proceed at Package A (50%) if we include the pilot→full path after the first 90-day review. That keeps risk low and lets us scale funding only once outcomes are proven.”

If timing is the blocker:

“Let’s fund the first module this FY and pre-allocate the remainder in next year’s L&D. I’ll schedule the review gate for 60 days in.”

Quick checklist before you negotiate

- ROI calculator screenshot (NPV, payback, sensitivity)

- Three MESO packages printed on one slide

- Guardrails calendar (blackouts, exam weeks, on-call plan)

- Draft retention clause (pro-rated, exceptions on layoff/role elimination)

- Module-to-Business Win table with named executive owners

Stay tuned for Parts 2 & 3, where you’ll get a simple ROI calculator and a ready-to-use pitch kit (email + 5-slide deck), deal-structure menu, and stakeholder matrix to make the case with your leaders. If this is something of your interest, consider subscribing to our Technology Leadership Newsletter so you don’t miss the next two parts.

Key Takeaways (Conclusion)

- Stage if timing is tight. Propose “pilot module now, remainder next FY” so Finance can spread costs and de-risk the decision.

- Lead with outcomes, not education. Position the MBA as a retention + capability investment that advances the company’s OKRs.

- Convert modules into artifacts. Ship CFO-ready business cases, reliability playbooks, AI feasibility briefs, etc. One artifact per module, with an exec owner.

- Time your ask to the fiscal calendar. Aim 60–90 days before AOP lock; ride L&D resets and performance-review moments when retention is on the agenda.

- Bring decision-grade evidence. ROI snapshot (NPV, payback, sensitivity), short payment schedule, and a delivery guardrails plan (study-hour cap, blackout windows, on-call exclusions).

- Co-supervise with owners. Secure written sign-off from the CFO/COO/CISO counterparts tied to each metric because each signature boosts approval odds.

Frequently Asked Questions (FAQ)

How much sponsorship should I ask for: 50%, 75%, or 100%?

Start with 75% as your anchor if the Module-to-Business table shows a clear OKR impact and you offer a pro-rated retention clause. Include a fallback 50% option and a pilot-now, remainder-next-FY path to make “yes” easy.

When’s the best time to ask?

60–90 days before budget lock for your company’s fiscal year. Also align with L&D resets and performance-review cycles so your proposal lands during retention and planning moments.

What if my company doesn’t have a formal tuition policy?

Pitch it as a retention-and-capability pilot: tie funding to OKR-linked deliverables, include guardrails (study-hour cap, blackout dates, grade threshold), and propose a 12–18-month pro-rated retention clause. Finance can stage payments across fiscal years.

Won’t study time hurt delivery?

Your plan should ensure delivery: cap study hours, define release blackout windows, exclude on-call weeks from exams, name coverage owners, and tie each module to artifacts the org already needs, so the business is buying outcomes, not time off.